arizona maricopa county tax lien

Learn to buy tax liens in Maricopa County AZ today. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

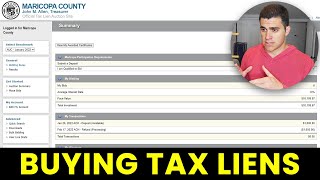

Maricopa County Treasurer S Office John M Allen Treasurer

Check your Arizona tax liens.

. The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the. A number will be assigned to each bidder for use when.

The initial step is for the IRS or local tax agency to decide that a person truly owes back. Maricopa County AZ currently has 18343 tax liens available as of October 17. 9 Arizona counties have now released their 2022 Tax Lien auction properties.

Arizona Department of Revenue 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be. Furthermore some offices eg. Jefferson St Suite 140 Phoenix AZ 85003.

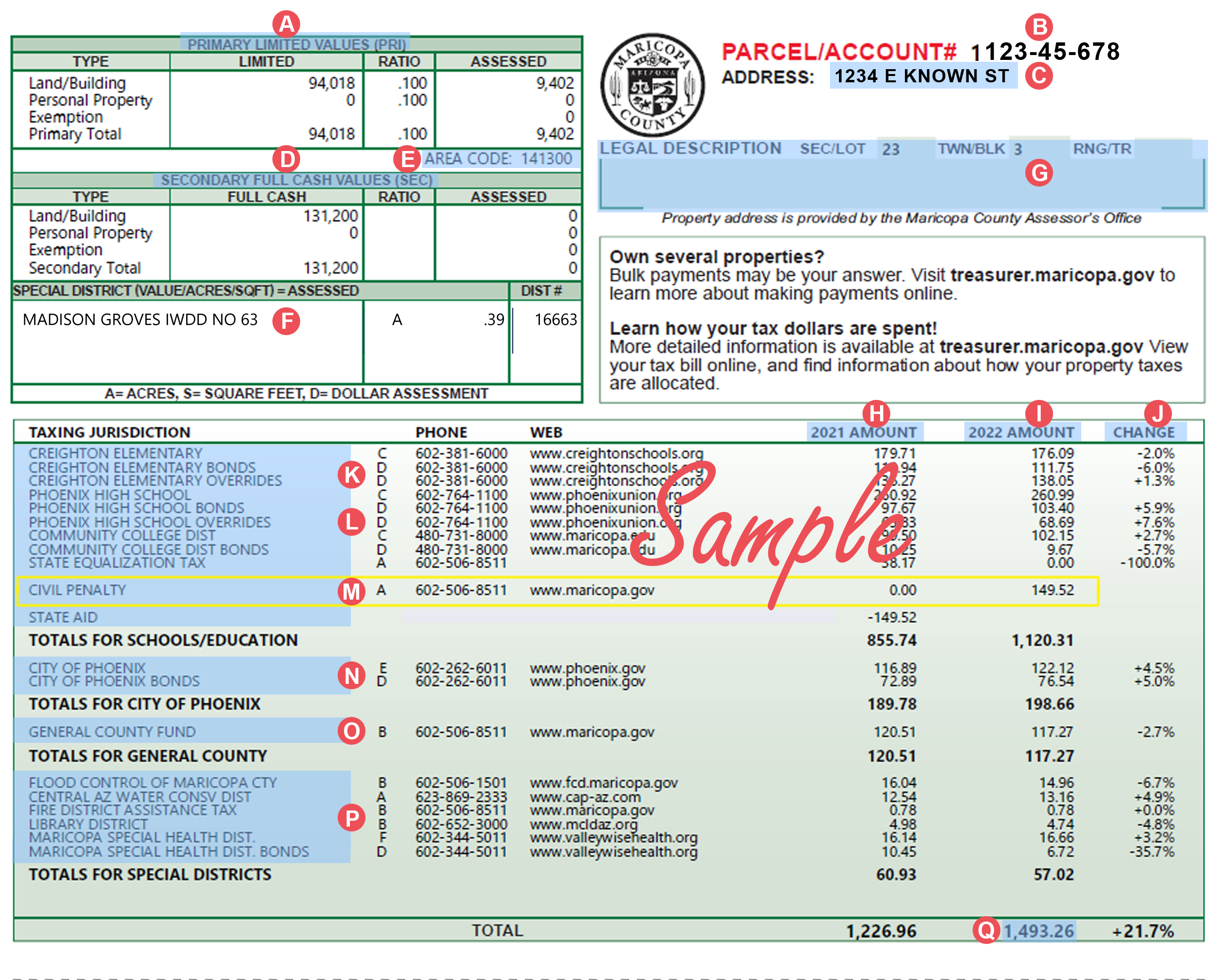

The process of imposing a tax lien on property in Maricopa County Arizona is typically fairly simple. Welcome to the world of Maricopa County Arizonas Tax Liens. Maricopa county tax lien map.

The instructions and forms are also. 1 Parcels may be advertised but not auctioned. Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102.

Pursuant to Arizona Revised Statutes Title 42 Chapter 18 Article 3 Sections 42-18101 through 42-18126. Maricopa County Treasurer Attention Tax Lien Department 301 W. You can now map search browse tax liens in the Apache Cochise Coconino Maricopa Mohave Navajo Pima.

Maricopa County AZ currently has 14 tax liens available as of June 15. You will also need a Civil Cover Sheet. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including.

The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map. How to file a lien on a property in arizona. The Tax Lien Sale will be held on February 9 2021.

The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

Maricopa county lien search. Just remember each state has its own bidding process. Instructions and forms for filing an out-of-state or foreign judgment are available on the Clerks Forms page.

Form 140ET is used by individuals not required to file an Arizona individual. In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest. Tax Deeded Land Sales.

On a CD from the Research Material Buying Guide. 27 rows Tax Lien Statistics - as of 9262022. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Maricopa county tax lien sale 2022. Some offices including those in Gila County Maricopa County Pima County and Pinal County maintain websites for document searches.

A tax lien in.

Fill Free Fillable Forms Maricopa County Telecommunications

Arizona Tax Liens Maricopa County Tax Lien Research Tutorial

Maricopa County Assessor S Office

2013 2022 Form Az Gn10f Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Forms Maricopa County Telecommunications

Maricopa County Treasurer S Office John M Allen Treasurer

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Eastmark No 1 Eastmark No 2 And Cadence Cfd City Of Mesa

Arizona Tax Lien Sales For 2013 The Rules And Laws

How To Buy Tax Liens In Maricopa County Youtube

How To Buy Tax Liens Step By Step Walkthrough Youtube

Fillable Online Quit Claim Deed Maricopa County Fill Online Printable Fillable Fax Email Print Pdffiller

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

Challenging Your Maricopa County Tax Appraisal Law Office Of Laura B Bramnick

Free Arizona Quit Claim Deed Form Pdf Word Eforms

Affidavit Homeschool Maricopa County Pdf Form Formspal

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business